It has become necessary for an actuary (professionals as well as students) to leverage the power of data in their day-to-day analysis. From GLM models in pricing to claims fraud analysis, everything requires handling the huge data for which MS-Excel is no longer optimum. R programming has gained importance not only to handle data for analysis but for the current world of Machine Learning. This guide will help you to learn the basics of R programming required to handle the data in R. If you already know basics of R programming, you can skip ahead and start with ‘Quick-start guide to Machine Learning for Actuaries’ to understand how the knowledge of statistics & probability can be extended to building machine learning models like fraud analysis.

Based on your level of expertise in R, you can start learning from the following blogs.

Beginners

- R programming for Actuaries

- Getting started with analytics in R

- Basic of Probability and Statistics in R

- Getting started with ML- An introduction to demystify the topic for actuaries.

Intermediate

- R programming for intermediates

- 5 analytics an actuary can do for an insurance company

- Statistical Learning on the real world data

- 5 predictive models for Insurance Industry

Advanced

- Coming Soon

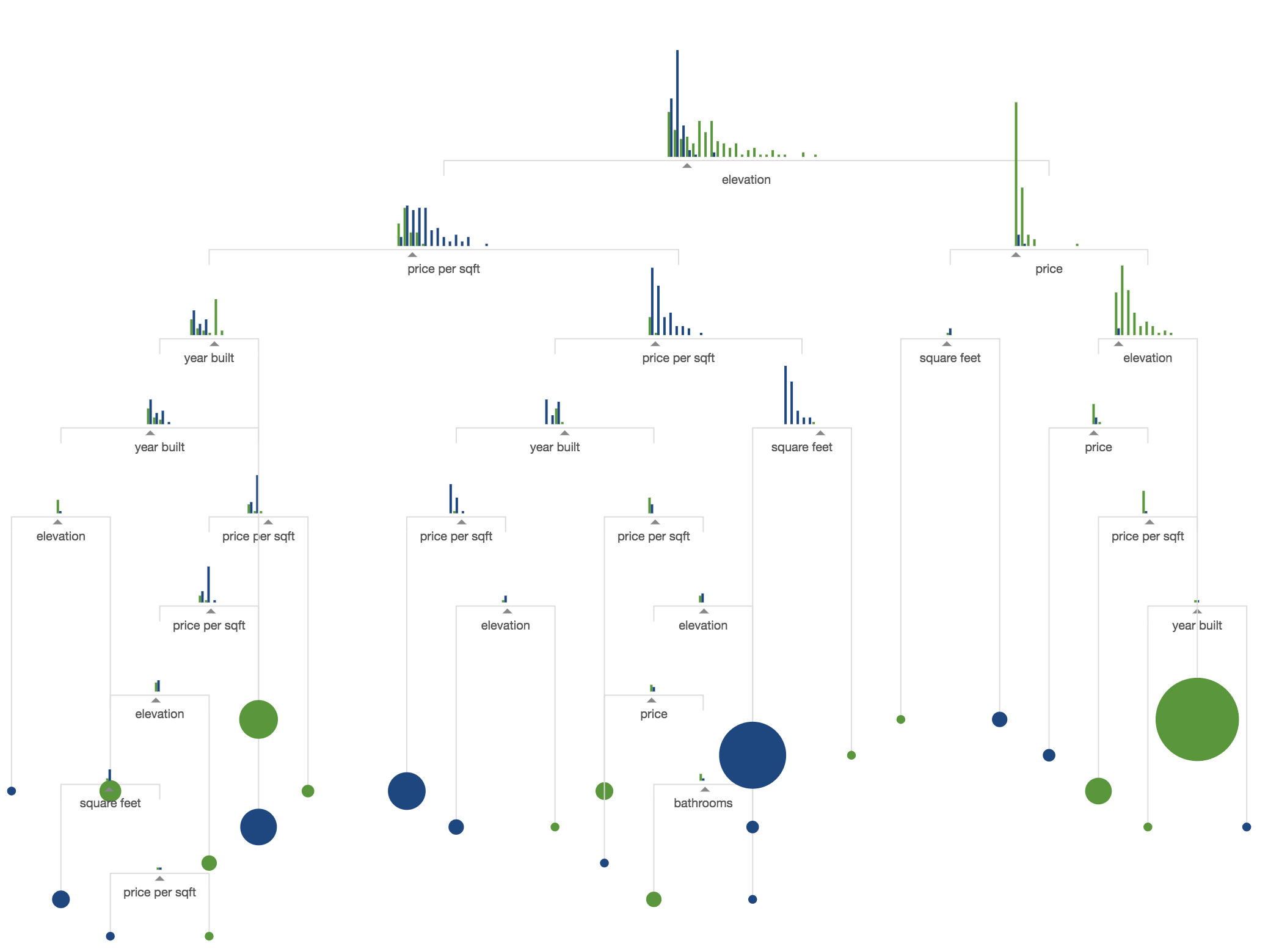

Introduction to ML for Actuaries - Part II: What are Decision Trees?

Introduction to ML for Actuaries - Part II: What are Decision Trees?